Renewable Energy Finance in the UK encompasses various funding solutions that facilitate the acquisition, installation, and maintenance of renewable energy systems. These solutions are designed to help businesses transition to sustainable energy sources without the upfront financial burden. In turn, the funding promotes greener and more cost-effective energy alternatives.

Hall Asset Finance is the premier asset and finance brokerage firm, specialising in facilitating the acquisition of renewable energy finance in the UK. We are dedicated to assisting businesses in navigating the complexities of securing finance and ensuring a sustainable and profitable investment in green energy.

Investing in renewable energy is a step towards environmental stewardship to make strategic business decisions. Opting for renewable energy finance through Hall Asset Finance can offer numerous advantages:

Transitioning to renewable energy systems such as solar panels, wind turbines, and biomass boilers can drastically reduce your energy expenses. Over time, the savings on utility bills can offset the initial investment costs, making renewable energy a cost-effective solution for your business.

Properties equipped with renewable energy systems are often valued higher than those without. Should you choose to lease or sell your business property, these installations can significantly increase its marketability and potential return.

Many governments offer tax incentives, rebates, or grants for businesses that adopt renewable energy technologies. These financial incentives can reduce the overall cost of installation and increase the ROI.

By using renewable energy sources, your business contributes to the reduction of greenhouse gas emissions. This not only helps combat climate change but also improves your company’s sustainability profile, which is increasingly valued by customers, investors, and regulatory bodies.

Utilising renewable energy significantly enhances your corporate social responsibility (CSR) profile. Demonstrating a commitment to sustainable practices can strengthen your brand reputation, improve customer loyalty, and attract like-minded investors and partners.

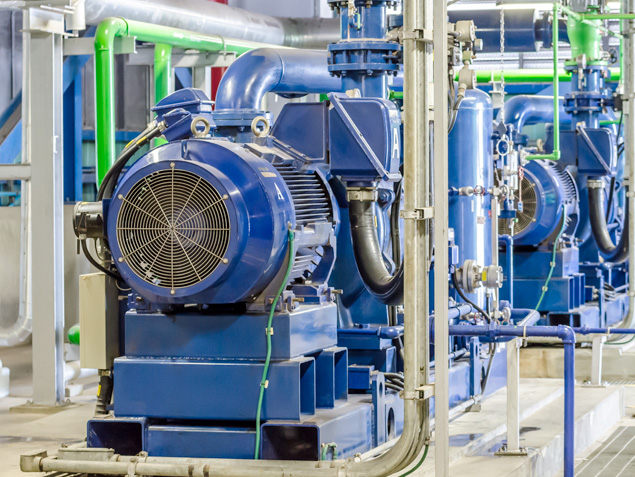

Hall Asset Finance offers tailored financing solutions for a range of renewable energy products, each designed to enhance your business’s sustainability and operational efficiency:

At Hall Asset Finance, the process of securing renewable energy finance typically spans 3 to 6 months. It starts with an initial consultation, followed by 2-4 weeks of preparing detailed project information. The application submission takes about 1-2 weeks, with a subsequent evaluation phase lasting 4-8 weeks as lenders conduct due diligence. Once approved, finalising terms and releasing funds takes an additional 2-4 weeks, with our expert guidance throughout.

At Hall Asset Finance, we understand that each renewable energy project is unique so we tailor our financial solutions accordingly. Our experts offer comprehensive guidance from the initial consultation where we assess your project's specific needs and objectives. We help you prepare compelling business cases, incorporating detailed financial forecasts and environmental impact assessments.

The application process for a renewable energy finance company can be challenging. We simplify this process by handling the intricacies of documentation and compliance requirements. We ensure your application is robust, meeting all the criteria set by potential lenders. By coordinating with these financial institutions, we reduce delays and improve the likelihood of a favourable outcome.

Securing the finances is just the beginning. At Hall Asset Finance, we continue to support our clients even after the funds have been disbursed. We offer ongoing management advice to ensure renewable energy projects remain viable and compliant. Our team is also on hand to assist with refinancing opportunities and adjustments to financial arrangements.