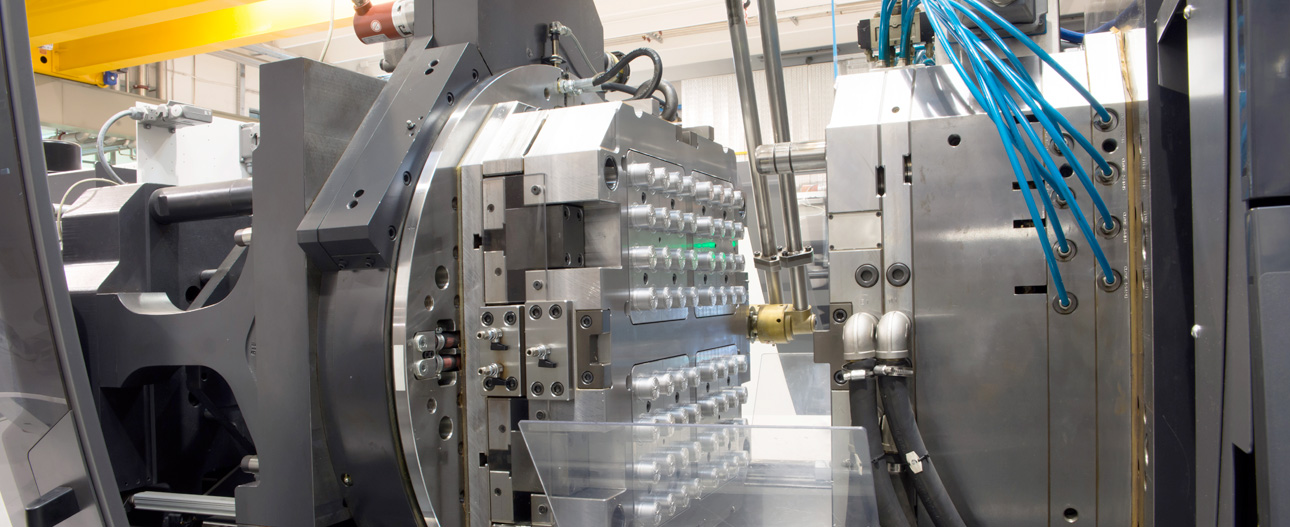

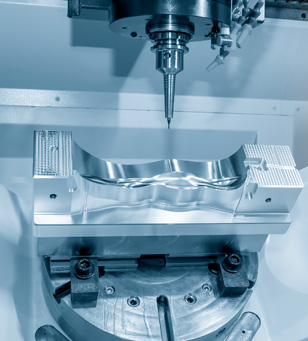

Injection moulding tool finance in the UK plays a crucial role for manufacturers looking to streamline production without the immediate capital expenditure of purchasing expensive machinery. This specialised form of finance allows businesses to invest in high-quality injection moulding tools that can produce complex and precise components essential for various industries, from automotive to consumer goods.

At Hall Asset Finance, we understand the unique challenges and opportunities that come with investing in injection moulding technology. Our bespoke brokering service connects our clients with a curated network of lenders who specialise in this niche area of finance. We work diligently to negotiate terms that align with our client’s financial realities and production timelines.

Here’s how we can facilitate your acquisition of essential manufacturing assets:

This option allows you to unlock the cash tied up in outstanding invoices. By advancing funds against amounts due from customers, businesses can invest in injection moulding tools without waiting for invoice settlements.

This type of finance is ideal for businesses looking to spread the cost of expensive machinery over time, making state-of-the-art technology accessible while preserving working capital.

Our comprehensive business loans can cover broader needs beyond just tool acquisition, including operational costs and other capital expenditures associated with expanding your injection moulding capabilities.

For businesses with existing assets, we offer the opportunity to refinance your injection moulding tools. This option can free up capital that is otherwise tied up in machinery.

Injection moulding tool finance offers a multitude of benefits that can significantly enhance operational efficiency:

By financing injection moulding tools rather than purchasing them outright, businesses can better manage their cash flow. This allows for more flexible budget allocation and the ability to invest in other critical areas.

Financial solutions like asset finance or leasing enable businesses to access the latest injection moulding technology. This means companies can produce higher quality products with greater efficiency.

Utilising finance options reduces the risk associated with large capital expenditures. Businesses can avoid the financial strain of significant one-time payments and remain agile in their financial planning and execution.

Many financing solutions for injection moulding tools offer potential tax benefits. For example, leasing payments can often be deducted as business expenses, reducing the net cost of financing and improving overall tax efficiency.

Choosing the right brokerage is crucial when securing finance for sophisticated manufacturing needs:

At Hall Asset Finance, we possess deep insights into the manufacturing sector, particularly in areas requiring advanced technologies like injection moulding.

This diversity allows us to secure competitive terms that might not be readily available through traditional channels, giving our clients the best possible financial solutions.

Every business has unique needs and circumstances, and our approach is to provide personalised advice and solutions that align with your specific business strategy and financial objectives.

Our expertise in the finance industry enables a streamlined application. We handle the complexities of finance negotiation and paperwork, allowing you to focus on what you do best—running your business.

Securing Injection Moulding Tool Finance is a strategic move to elevate your manufacturing capabilities. Here’s how Hall Asset Finance can guide you through the process:

Start with a comprehensive consultation where we assess your specific needs and discuss the financial implications of acquiring new injection moulding tools.

We will present you with a range of financing options from our extensive network of lenders. Our expertise enables us to recommend the most suitable terms and structures.

Our team assists in the preparation and submission of your finance application, ensuring that all documentation is complete, accurate, and optimised to increase the likelihood of approval.

We actively negotiate with lenders on your behalf to secure the best possible terms. Once an agreement is in place, we help finalise the details.

We provide ongoing support and advice to help manage your finance agreement effectively throughout its term, adapting to any changes in your business circumstances or objectives.

Ready to elevate your business with the right financing solutions? Connect with Hall Asset Finance today and discover how we can tailor financial strategies that align perfectly with your needs.

Whether you’re looking to invest in new equipment, expand operations, or enhance sustainability practices, our expert team is here to guide you – every step of the way!