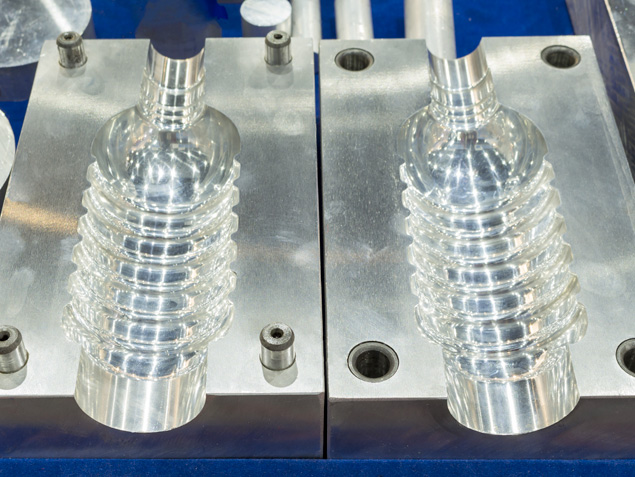

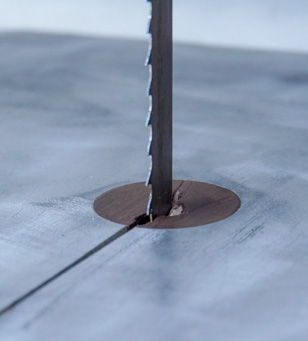

Bandsaw finance in the UK serves as a vital lifeline for woodworking and metalworking businesses aiming to enhance their operational capacity without bearing the full expense upfront. Bandsaws, those versatile tools capable of cutting through a variety of materials with precision, represent a significant investment. By spreading the cost over time through financing, firms can maintain cash flow and financial flexibility.

At Hall Asset Finance, we understand the critical nature of having the right equipment to sustain and grow your business. We act as the conduit between cutting-edge technology and our clients’ workshops. By brokering bandsaw finance, we enable our clients to acquire top-tier bandsaws without the prohibitive initial expense. Our bespoke approach means we assess each client’s specific needs and financial situation, then meticulously match them with lenders who offer the most favourable terms.

At Hall Asset Finance, we recognise financing solutions to support the acquisition of bandsaws, each tailored to different business requirements:

This option is ideal for businesses looking to maximise their borrowing potential against the value of existing assets, including new bandsaws. It provides a flexible funding line that grows in line with your sales.

For businesses with existing equipment, asset refinance allows you to unlock the equity in your bandsaws and other machinery. This can provide a vital cash injection to improve cash flow or invest in other areas of your business.

For companies involved in manufacturing or woodworking, where payments might be delayed, this can smooth out cash flow peaks and troughs, keeping your operations steady.

Payments are spread over an agreed term, with the option to acquire the asset at the end of the lease period. This is a cost-effective way to manage the budget while still benefiting from the latest machinery.

Investing in bandsaw finance presents benefits for businesses to maintain a competitive edge while managing their financial resources effectively:

By financing a bandsaw, businesses can avoid the significant capital outlay required for outright purchase, thereby preserving cash for other critical areas of operation.

Bandsaw finance allows companies to access the latest machinery without prohibitive costs. This ensures that businesses can utilise cutting-edge technology to improve efficiency and output quality.

Financing options such as leasing or invoice finance provide flexibility, allowing businesses to tailor their payment schedules to match their revenue patterns.

Utilising bandsaw finance can offer potential tax advantages. Lease payments can often be deducted as business expenses, potentially lowering the net cost of the finance and improving the overall financial standing of the business.

Here’s why Hall Asset Finance stands out as the preferred partner for your bandsaw financing needs:

At Hall Asset Finance, we pride ourselves on creating bespoke financing solutions that are meticulously tailored to the specific needs of each client.

With years of experience in the financial sector and a deep understanding of the manufacturing and woodworking industries, our team offers insights and advice that go beyond mere financial brokerage.

Our robust network of lenders includes both mainstream banks and niche financial institutions, giving us the flexibility to secure the most competitive rates and terms for our clients.

Our relationship with clients doesn’t end with the finalisation of a finance deal. We view each client as a long-term partner and are committed to supporting their growth and success.

Navigating the process of securing bandsaw finance in the UK can seem daunting. Here’s how we facilitate bandsaw finance for your business:

Begin with a comprehensive consultation to discuss your specific equipment needs and financial circumstances. Our experts at Hall Asset Finance assess your situation to recommend the most suitable financing options.

We assist in gathering all necessary documentation, from proof of income to business financial statements, ensuring your application is robust and complete.

Leveraging our extensive network of lenders, we compare various financing offers to find the most advantageous terms for you. Our expertise allows us to negotiate better rates and conditions.

Once you select the best finance option, we handle the submission on your behalf. Our proactive approach aims to expedite the approval process, so you can acquire the bandsaw without unnecessary delays.

After securing the finance, our commitment to your success continues. We provide ongoing support and advice to explore further opportunities to enhance your operational capacity and financial health.

Ready to elevate your business with the right financing solutions? Connect with Hall Asset Finance today and discover how we can tailor financial strategies that align perfectly with your needs.

Whether you’re looking to invest in new equipment, expand operations, or enhance sustainability practices, our expert team is here to guide you – every step of the way!